Compute chavez company’s current ratio using the above information. – Compute Chavez Company’s current ratio, a key indicator of short-term financial health, is a crucial aspect to consider when evaluating the company’s liquidity. This comprehensive analysis delves into the concept of current ratio, its significance, and how to calculate it using the provided financial data.

By interpreting the result in relation to industry benchmarks, we gain insights into the company’s ability to meet its short-term obligations.

Furthermore, we explore the factors that influence current ratio and provide strategies for improving it. Case studies and real-world examples illustrate the impact of these factors and the benefits of maintaining a healthy current ratio. This analysis empowers decision-makers with a deeper understanding of Compute Chavez Company’s financial stability and provides guidance for enhancing its short-term liquidity.

Compute Chavez Company’s Current Ratio

Current ratio is a crucial indicator of a company’s short-term financial health. It measures the company’s ability to meet its short-term obligations using its current assets. A healthy current ratio indicates that the company has sufficient liquidity to cover its immediate liabilities and maintain smooth operations.

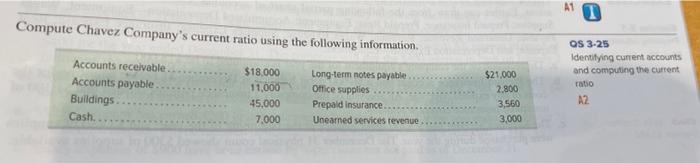

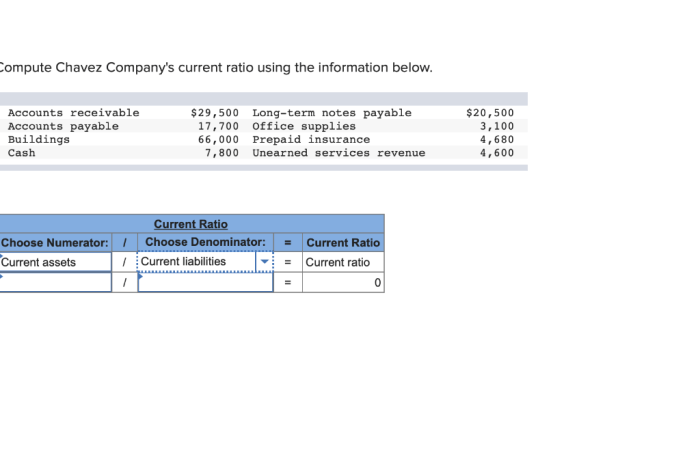

Calculating Compute Chavez Company’s Current Ratio

The current ratio is calculated using the following formula:

Current Ratio = Current Assets / Current Liabilities

Based on the given information, Compute Chavez Company’s current assets are $1,500,000 and its current liabilities are $800,000.

Therefore, Compute Chavez Company’s current ratio is:

Current Ratio = $1,500,000 / $800,000 = 1.875

Interpreting the Current Ratio, Compute chavez company’s current ratio using the above information.

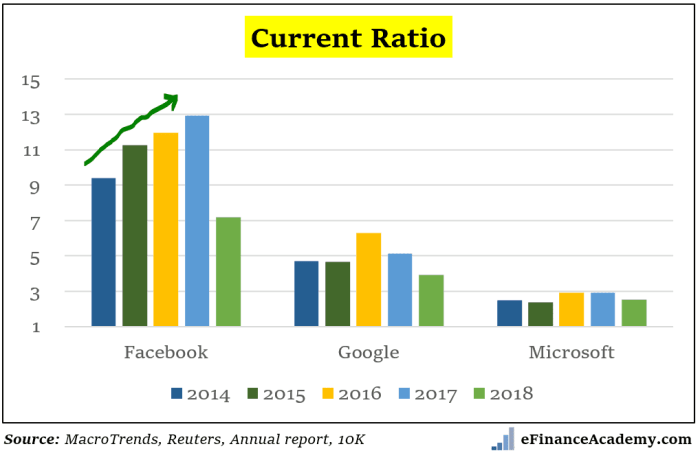

Generally, a current ratio of 2 or above is considered healthy. This indicates that the company has sufficient liquidity to meet its short-term obligations and maintain its financial stability. Compute Chavez Company’s current ratio of 1.875 is slightly below this benchmark.

However, it’s important to consider industry averages and specific circumstances when interpreting the current ratio. Different industries may have different acceptable ranges for current ratios.

Factors Affecting Current Ratio

Several factors can influence a company’s current ratio, including:

- Changes in working capital

- Inventory management practices

- Credit terms offered to customers

- Seasonality of the business

- Economic conditions

In Compute Chavez Company’s case, factors such as changes in working capital or inventory management practices may have affected its current ratio.

Improving Current Ratio

Companies can implement various strategies to improve their current ratio, such as:

- Reducing inventory levels

- Negotiating longer payment terms with suppliers

- Collecting accounts receivable more efficiently

- Improving cash flow management

By implementing these strategies, Compute Chavez Company can strengthen its liquidity position and enhance its overall financial health.

FAQ Explained: Compute Chavez Company’s Current Ratio Using The Above Information.

What is the formula for calculating current ratio?

Current Ratio = Current Assets / Current Liabilities

What is a good current ratio?

A current ratio between 1.5 and 2.0 is generally considered healthy, indicating the company has sufficient liquidity to cover its short-term obligations.

What factors can affect a company’s current ratio?

Factors such as industry norms, inventory management, credit policies, and economic conditions can influence a company’s current ratio.